Ever wondered why your insurance might say “no” to Ozempic? The drug’s popularity for diabetes management and weight loss has insurers tightening the reins, but knowing the rules can turn a denial into an approval.

What is Ozempic and Why Insurers Scrutinize It

When you first hear about Ozembic is a once‑weekly injectable GLP‑1 receptor agonist (semaglutide) approved for type 2 diabetes and, in higher doses, for chronic weight management. Its brand‑name reputation, high price tag (about $900‑$1200 a month in NewZealand), and growing off‑label use have made it a hot target for private health insurers. Insurers view it as a high‑cost specialty drug that could be replaced by cheaper alternatives, so they often demand strict proof of medical need.

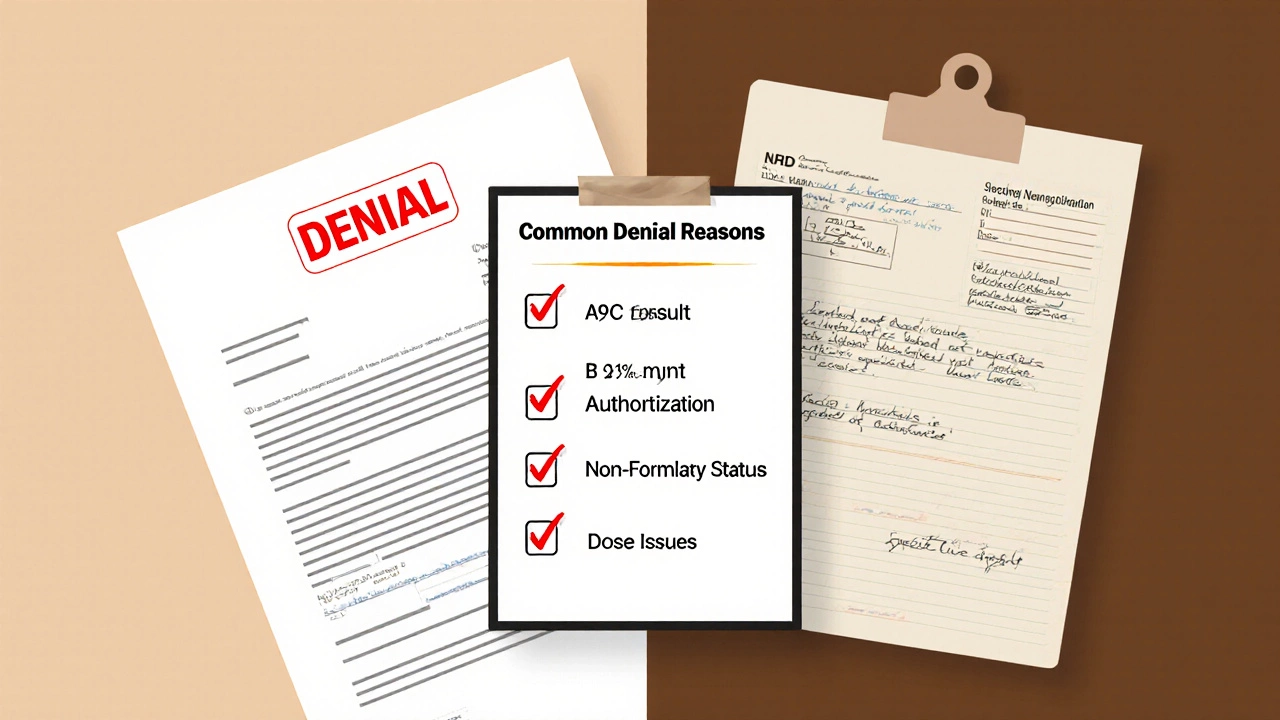

Common Reasons Insurers Deny Coverage

- Missing prior authorization - Most plans require a formal request showing why Ozembic is medically necessary.

- Failure to meet medical necessity criteria - insurers typically ask for documented A1C levels above 7.5% or a BMI≥30kg/m² with documented unsuccessful weight‑loss attempts.

- Use of an unapproved dose - Only the 1mg dose is covered for diabetes; the 2mg weight‑loss dose often triggers a denial.

- Insurance formularies that label Ozembic as “non‑formulary” - It means the drug isn’t on the preferred list, so a higher‑cost tier applies.

- Incomplete documentation - Missing lab results, specialist letters, or a clear treatment plan can halt approval.

How Different Insurance Types Handle Ozembic

| Insurance Type | Formulary Status | Prior Authorization Required? | Typical Approval Criteria | Patient Cost Share |

|---|---|---|---|---|

| Private Health Insurer | Tier3 - non‑preferred | Yes | A1C>7.5%orBMI≥30kg/m²+failed diet/exercise | 30‑40% co‑pay |

| Medicare PartD | Covered under specialty tier | Yes | Diabetes diagnosis+A1C≥8%or documented obesity with specialist endorsement | 25% after deductible |

| Medicaid (state‑specific) | Varies - often “formulary‑restricted” | Sometimes | Physician‑signed justification, proof of failed first‑line therapy | Minimal or $0 |

| Employer‑Sponsored Plans | Typically Tier2‑3 | Yes | Same as private but may include step‑therapy requirements | Co‑pay depends on tier |

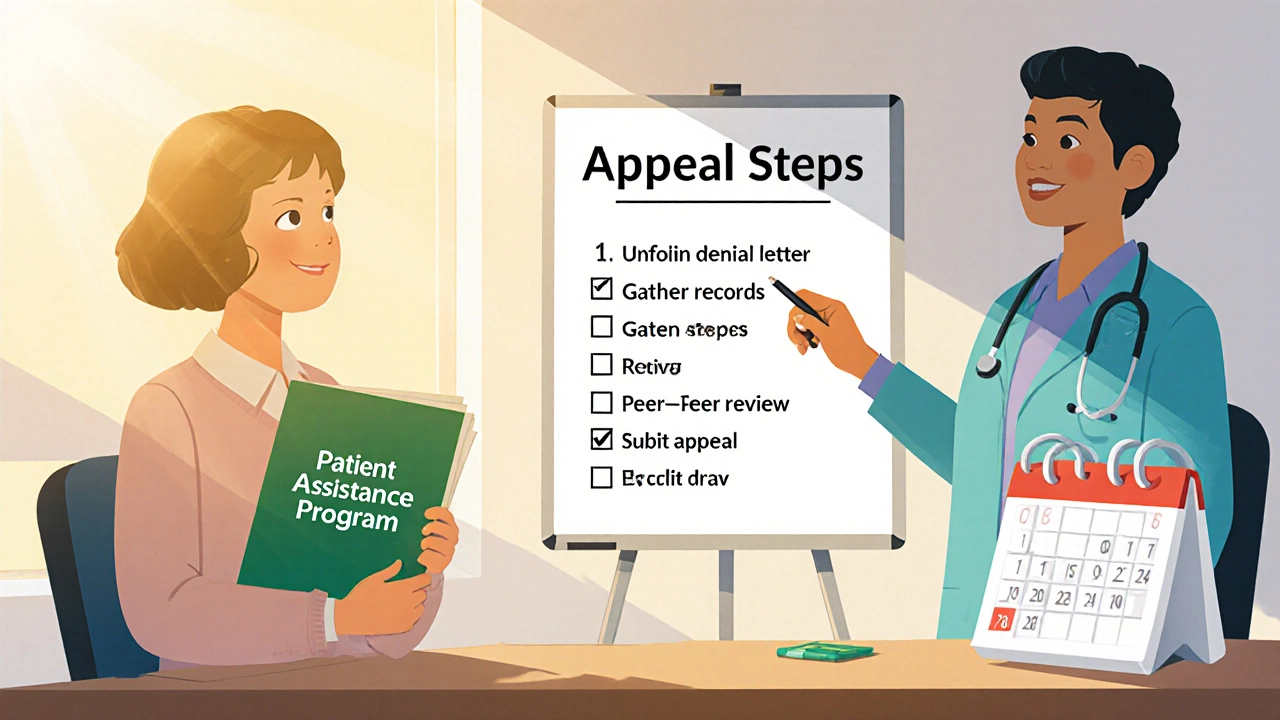

Steps to Fight a Denial

- Obtain the denial letter - It spells out the exact reason (e.g., “medical necessity not met”).

- Gather supporting records - Latest A1C, BMI, diet/exercise logs, and specialist notes.

- Request a peer‑to‑peer review - Your doctor can discuss the case directly with the insurer’s medical director.

- Submit an appeal - Include a cover letter, a physician’s statement, and any missing labs.

- Escalate if needed - Contact the state insurance ombudsman or consider a third‑party appeals service.

Most insurers give you 30days to appeal. Acting quickly and supplying complete paperwork raises the approval odds to roughly 70% according to a 2024 health‑policy analysis.

Tips to Boost Your Chance of Approval

- Start with a thorough prior authorization request - Use the insurer’s specific form.

- Include a clear treatment narrative - Explain why cheaper options (metformin, GLP‑1 alternatives) failed.

- Highlight comorbidities - Hypertension, sleep apnea, or fatty liver disease strengthen the case.

- Leverage a Patient Assistance Program (PAP) - Many manufacturers offer free or discounted doses while the appeal is pending.

- Ask your prescriber to use the exact diagnostic codes (ICD‑10 E11.9 for diabetes, E66.9 for obesity) the insurer expects.

Alternatives If Coverage Falls Through

If after two appeals Ozembic still isn’t covered, consider these paths:

- Switch to a lower‑cost GLP‑1 like Saxenda (liraglutide) - Many plans have it on a preferred tier. \n

- Enroll in a clinical trial - Universities in Auckland and Wellington are testing newer semaglutide formulations with free medication.

- Use a compounded version - Some pharmacies can create a custom semaglutide dose at a reduced price, though insurance may still consider it experimental.

- Explore non‑pharmacologic programs - Accredited diet‑coach services that some insurers cover 100%.

Quick Checklist Before You Submit a Claim

- Verify your plan’s formulary tier for Ozembic.

- Complete the insurer’s prior‑authorization form.

- Attach recent A1C, BMI, and a detailed physician letter.

- Check if a Ozembic insurance appeal window is open.

- Enroll in a manufacturer PAP as a backup.

Frequently Asked Questions

Why does my insurer label Ozembic as “non‑formulary”?

A non‑formulary label means the drug isn’t on the plan’s preferred list, usually because it’s more expensive than alternatives. Insurers can still cover it, but only after a rigorous medical‑necessity review.

Can I get Ozembic for weight loss without a diabetes diagnosis?

Yes, the higher 2mg dose is FDA‑approved for chronic weight management. However, many insurers restrict coverage to patients with a documented BMI≥30kg/m² and proof that diet‑exercise interventions failed. Without that documentation, the claim is likely denied.

How long does an appeal process usually take?

The first‑level appeal is usually processed within 15‑30days. If you move to an external review, it can add another 30‑45days. Acting promptly and providing complete documentation shortens each step.

Are there any tax‑benefit programs that can help with Ozembic costs?

In NewZealand, the Pharmaceutical Management Agency (PHARMAC) sometimes subsidizes high‑cost diabetes drugs. Checking your eligibility for PHARMAC’s special dispensing program can reduce out‑of‑pocket expenses significantly.

What should I do if my appeal is rejected again?

You can request an external review by an independent medical reviewer, contact your state’s health‑insurance regulator, or work with a patient‑advocacy group that specializes in specialty‑drug denials. Some patients also switch to a covered alternative while continuing to gather data for a future appeal.

Categories

Popular Articles

Mar 17 2025

Mar 10 2025